Homeowners often wonder if they have to use insurance money for roof repairs. The answer might surprise you. Not using the money as intended could lead to serious issues. For example, it might be seen as fraud. Also, neglecting roof repairs is bad for your home.

Key Takeaways:

- Insurance payouts for roof repairs should be used for their intended purpose to prevent insurance fraud and homeowner neglect.

- Homeowners should review their insurance policies to understand the coverage for roof damage.

- In some cases, insurance may cover the cost of replacing the entire roof, even for partial damage.

- If matching roof materials are unavailable, insurance may approve the replacement of the entire roof.

- Homeowners have responsibilities to maintain their roofs and are responsible for damages resulting from neglect and lack of maintenance.

Understanding the Coverage

Your home’s safety is key, and that’s where homeowners insurance comes in. It helps financially if your roof gets damaged. It’s crucial to know what damage your policy covers.

Insurance often covers roof repair or replacement for various damages. This includes damage from falling objects, fire, hail, lightning, and more.

- Falling objects: Insurance can help if something like a tree limb hits your roof and damages it.

- Fire: Covering roof damage from fires is common in insurance policies.

- Hail: Insurance usually helps with hail damage on your roof.

- Lightning: If lightning hits your roof, insurance might cover it.

- Smoke damage: Nearby fires or smoke can damage your roof, and insurance could help.

- Weight of ice and snow: In snowy areas, if snow damages your roof, insurance might cover it.

- Wind: Strong winds that harm your roof are often included in insurance coverage.

- Vandalism: If someone vandalizes your roof, insurance could pay for the repairs.

But, not all roof damages may be covered. It varies, so read your policy well. Understand what’s covered and what’s not.

Stay informed about your insurance. Talk to your agent and read your policy. This knowledge helps you plan better for potential roof damage.

When fixing your roof, know what your insurance covers. This helps you budget right. For clarity on your coverage, chat with your agent or review your policy.

Protecting Your Investment

Your roof is vital for your home’s protection. Keep it well-maintained. Understand your insurance to avoid trouble and ensure your home’s safety.

Insurance for Partial Roof Damage

If your roof suffers partial damage, you might wonder about your insurance. Will it only cover fixing the part that’s damaged? Well, in some cases, your insurer could pay for a whole new roof. So, you might get help to replace your entire roof, even if just a part is damaged.

For example, if your roof gets hit by hail and only part of it is damaged, getting just that part fixed might not be the best idea. Hail can weaken the whole roof, making it less sturdy. This could cause problems later on. Therefore, your insurer might suggest replacing the whole roof to avoid future issues.

Speaking with your insurance adjuster is key if your roof has partial damage. They’ll look at your roof’s condition and how the damage affects it. By talking to them, you’ll understand what is and isn’t covered. This can help you make smart choices about what to do next.

Dealing with partial roof damage through insurance is not just about fixing your home. It’s also about protecting your money. If you need a new roof and your policy covers it, you’ll keep your home safe and possibly increase its value. This way, you avoid more problems later.

Insurance for Matching Issues With Roof Material

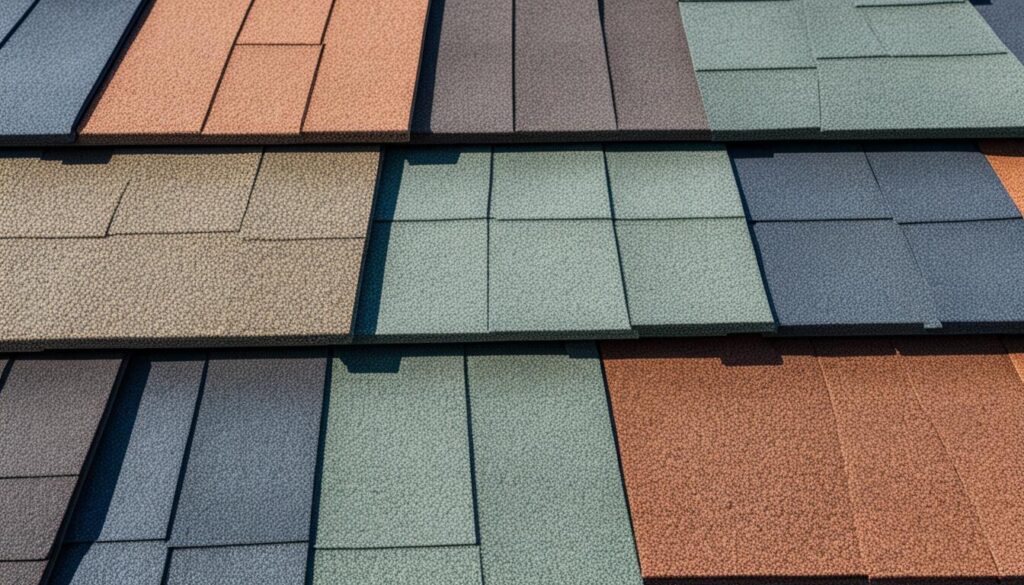

If the roof materials you need are not available, your insurance might pay for a full roof replacement. This is to make sure all materials match. For example, if you have old slate tiles that can’t be found, replacing only the broken ones might look odd. It’s important to talk to your insurance adjuster about what you can do.

Finding the same roof materials for repairs can be hard. Some materials are not made anymore or are not sold. If you can’t find a match, your insurance could cover getting a whole new roof. This keeps everything looking the same and your house looking good.

Replacing only the damaged tiles may result in a mismatched appearance.

Imagine if your roof has tiles that haven’t been sold for years. If some break, getting the same ones could be impossible. In such a case, you might get a new roof from your insurance. This way, everything will look right, which is important for the look and value of your home.

It’s essential to talk to your insurance about your options. They can look at your situation and see what your policy allows. Getting a new roof can keep your home looking good and holding its value.

Expert Tip: Consider Upgrading Your Roof

Getting a full roof replacement could be a chance to get a better, more modern roof. If your insurance will pay for a new roof because of old materials, think about upgrading. A new roof can make your home safer, more efficient, and look nicer.

Before deciding on an upgrade, ask your insurance adjuster about costs and coverage. They can help you pick the best new material within your policy’s limits.

Homeowner Responsibilities and Exclusions

Homeowners must know what their insurance covers and excludes. The policy helps with many damages, but not all. It’s key to be aware of what’s not included too.

Things like not keeping up with maintenance won’t be covered. It’s on you to check your roof often and fix issues early. If you neglect this, claims might not get approved.

Also, some natural events won’t be covered by default. This includes earthquakes and floods. You might need to add special coverage if you’re in an area at risk.

Normal roof wear isn’t part of most policies either. Roofs get older and show it. This aging, like cracks and weathering, is usually the homeowner’s duty.

Cosmetic damage might not qualify for a claim as well. Let’s say hail dents a metal roof. Repairing these dents is likely not covered, unless the roof’s function is affected.

Knowing what your insurance doesn’t pay for is crucial. It helps you take better care of your home. This way, you can prevent issues and keep your house safe for the long haul.

Conclusion

It’s vital for homeowners to know why not using insurance money for roof repairs is a big deal. Avoiding necessary repairs can lead to insurance fraud. It also means not keeping up with important upkeep.

Using your insurance payout the right way protects your home for the long run. It keeps in line with your insurance policy, making sure everything is above board. Fixing roof problems quickly is vital. It keeps the home’s structure sound and makes sure it’s a safe, comfy place to live.

Remember, insurance is there to help with roof repairs for a good reason. It shields homeowners from sudden harm and keeps their homes safe. By doing your part as a homeowner, you can dodge trouble. Use the payout to fix your roof fast. This way, you keep your biggest investment secure and avoid messy legal and financial issues.

Meet William Adams, a seasoned roofing expert with over 30 years of hands-on experience in the industry. Having worked tirelessly under the scorching sun and through the fiercest storms, William brings a wealth of knowledge and expertise to the table. Hailing from the heart of the USA, he’s witnessed the evolution of roofing practices firsthand, mastering every aspect along the way. Now retired from the field, William spends his days cherishing time with his loved ones while sharing his invaluable insights through this platform. With William at the helm, you can trust that every tip, advice, and recommendation provided is backed by years of real-world experience and unwavering dedication to quality craftsmanship. Join us as we journey through the world of roofing, guided by the wisdom and passion of a true industry veteran.